Will Bitcoin Halving Benefit Long-Term Investors?

Yes, Bitcoin halving can benefit long-term investors. It reduces supply, potentially increasing demand and value over time. Bitcoin halving

Yes, Bitcoin halving can benefit long-term investors. It reduces supply, potentially increasing demand and value over time.

Bitcoin halving occurs approximately every four years, cutting the reward miners receive by half. This event aims to control inflation and ensure a finite supply of 21 million bitcoins. Historically, halvings have led to significant price increases, driven by reduced supply and heightened demand.

For long-term investors, this can mean substantial gains if the pattern holds. Understanding the mechanics of Bitcoin halving and its historical impact is crucial for making informed investment decisions. As the next halving approaches, many are speculating on its potential to drive prices higher, reinforcing Bitcoin’s appeal as a long-term investment.

:max_bytes(150000):strip_icc()/bitcoin-halving_sourcefile-v2-5952611ae43d461a8d2414b31bfb8ca0.png)

Bitcoin Halving Concept

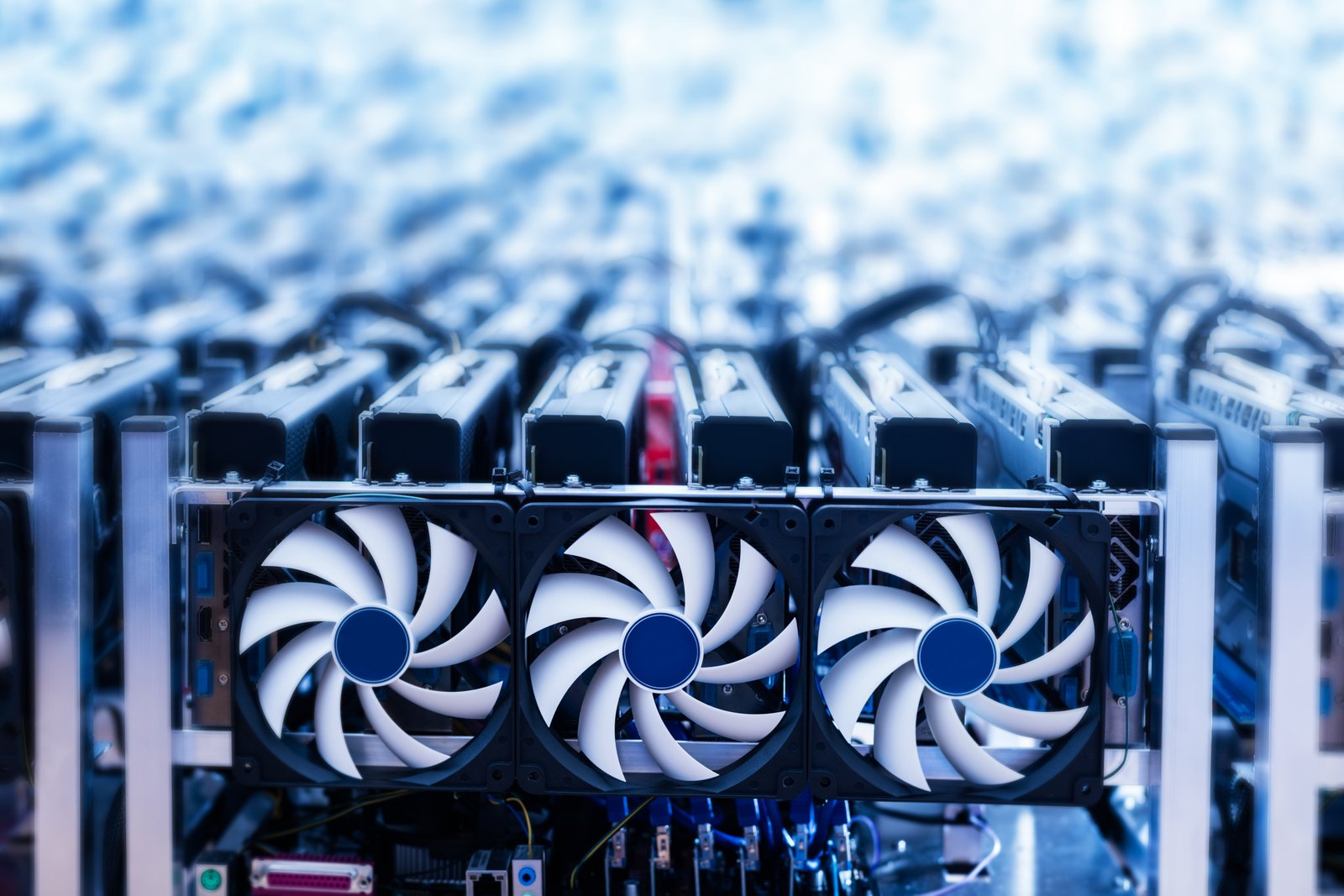

Bitcoin halving is a significant event in the cryptocurrency world. This event impacts the supply and demand of Bitcoin. Every four years, the reward for mining Bitcoin is halved. This reduces the number of new Bitcoins entering circulation. It makes Bitcoin more scarce and can affect its price.

Historical Context

Bitcoin was created in 2009 by an unknown person or group named Satoshi Nakamoto. Since then, Bitcoin has gone through several halvings. The first halving occurred in 2012. The mining reward dropped from 50 BTC to 25 BTC. The second halving happened in 2016, reducing the reward to 12.5 BTC. The third halving took place in 2020. The reward decreased to 6.25 BTC.

Each halving event has had a significant impact on Bitcoin’s price. In 2012, the price surged from $12 to $1,150 within a year. In 2016, the price rose from $650 to nearly $20,000 by the end of 2017. The 2020 halving also saw a price increase. It went from around $9,000 to over $60,000 in 2021.

Mechanics Of Halving

The Bitcoin network operates on a decentralized ledger called the blockchain. Miners validate transactions and add them to the blockchain. They receive Bitcoin as a reward for their work. Halving reduces this reward by 50%. The process ensures that only 21 million Bitcoins will ever exist.

Each halving event makes Bitcoin more scarce. This scarcity can lead to higher demand and increased prices. Miners need to adjust their operations. They must ensure profitability despite reduced rewards. Halving events occur every 210,000 blocks, roughly every four years.

| Halving Event | Date | Block Reward Before | Block Reward After |

|---|---|---|---|

| First Halving | November 28, 2012 | 50 BTC | 25 BTC |

| Second Halving | July 9, 2016 | 25 BTC | 12.5 BTC |

| Third Halving | May 11, 2020 | 12.5 BTC | 6.25 BTC |

Impact On Bitcoin Supply

Bitcoin halving is a highly anticipated event in the crypto world. It directly impacts the Bitcoin supply. This event occurs roughly every four years. During halving, the reward for mining new Bitcoin blocks is cut in half. This reduction significantly influences Bitcoin’s supply dynamics.

Reduction In New Coins

Each Bitcoin halving event reduces the number of new coins entering the market. Initially, miners received 50 Bitcoins per block. After the first halving, they received 25 Bitcoins. The reward then dropped to 12.5, and most recently, to 6.25 Bitcoins per block.

| Halving Event | Block Reward |

|---|---|

| First Halving | 25 BTC |

| Second Halving | 12.5 BTC |

| Third Halving | 6.25 BTC |

This reduction decreases the influx of new coins. Miners now receive fewer rewards for their efforts. This scarcity is crucial for Bitcoin’s value proposition.

Influence On Scarcity

The halving event makes Bitcoin scarcer over time. Scarcity plays a key role in Bitcoin’s value. There will only ever be 21 million Bitcoins. Halving ensures fewer coins are available each cycle.

- Increased scarcity drives demand.

- Lower supply often boosts Bitcoin’s price.

- Investors view Bitcoin as digital gold.

The limited supply appeals to long-term investors. They see potential in holding a scarce asset. As the supply decreases, the value may increase. This can benefit those with a long-term investment horizon.

Market Reactions

Bitcoin halving events create significant interest in the cryptocurrency market. These events cut the reward for mining new blocks in half. This reduction affects the supply side of Bitcoin. It can lead to various market reactions. Investors and traders closely watch these events. They try to predict price movements and market sentiment.

Price Fluctuations

Bitcoin prices often experience sharp fluctuations around halving events. Historical data shows that prices usually rise before and after halving. This happens due to the reduced supply of new Bitcoins. The supply and demand dynamics change, leading to price adjustments.

Let’s look at the past halvings:

| Halving Event | Date | Price Before Halving | Price After Halving |

|---|---|---|---|

| First Halving | Nov 28, 2012 | $12 | $1,000 (one year later) |

| Second Halving | Jul 9, 2016 | $650 | $2,500 (one year later) |

| Third Halving | May 11, 2020 | $8,500 | $60,000 (one year later) |

These figures highlight the potential for substantial price increases. Investors should be aware of these patterns.

Investor Sentiment

Investor sentiment plays a crucial role during Bitcoin halving events. Positive sentiment can drive prices up. Negative sentiment can cause price drops. Social media platforms, news outlets, and forums buzz with discussions.

Investors often feel:

- Excitement about potential gains.

- Fear of missing out (FOMO).

- Uncertainty about market stability.

Long-term investors benefit from understanding these sentiments. They can make informed decisions. Monitoring sentiment indicators can provide valuable insights. Sentiment analysis tools help gauge the market mood.

In summary, market reactions to Bitcoin halving are multifaceted. Price fluctuations and investor sentiment are key components. Long-term investors should keep a close eye on these factors. This can help them maximize their investment returns.

Long-term Investment Strategy

The concept of a long-term investment strategy is crucial for those considering Bitcoin. Long-term investors focus on the potential growth over years, not just immediate gains. This approach can help mitigate risks and maximize returns.

Risk Management

Managing risk is essential for long-term Bitcoin investors. Diversifying your portfolio can be a key strategy. Don’t put all your money into Bitcoin. Consider other assets like stocks, bonds, and real estate.

Another important aspect is to stay informed. Keep up with Bitcoin news and market trends. This can help you make informed decisions.

Also, use secure wallets to store your Bitcoin. This can protect you from hacks and theft.

Potential Returns

Bitcoin halving events can impact the market significantly. Halving reduces the rewards miners get, which can increase Bitcoin’s value. This can benefit long-term investors.

Historically, Bitcoin’s price has surged after halving events. For example, after the 2016 halving, the price jumped from $650 to nearly $20,000 in 2017.

Here is a table showing the impact of past halving events:

| Year | Pre-Halving Price | Post-Halving Price |

|---|---|---|

| 2012 | $12 | $1,000 |

| 2016 | $650 | $20,000 |

| 2020 | $8,800 | $64,000 |

These historical trends suggest that Bitcoin halving can lead to significant returns. Long-term investors could benefit by holding onto their Bitcoin through these events.

In summary, a long-term investment strategy in Bitcoin requires careful risk management and an understanding of potential returns. Stay informed, diversify, and secure your assets to maximize your investment potential.

Comparative Analysis

Bitcoin halving is a key event in the cryptocurrency world. Many investors wonder if it benefits long-term holders. This section provides a comparative analysis. It compares Bitcoin halving with other investment types.

Other Cryptocurrencies

Bitcoin is not the only cryptocurrency with halving events. Other coins, like Litecoin, also have halving. These events reduce coin supply. It often leads to price increases.

Here’s a table comparing Bitcoin and Litecoin halving:

| Aspect | Bitcoin | Litecoin |

|---|---|---|

| Supply Reduction | 50% | 50% |

| Frequency | Every 4 years | Every 4 years |

| Market Impact | High | Moderate |

Bitcoin often gains more attention. It has a larger market cap. Litecoin follows Bitcoin’s trends but with less impact.

Traditional Investments

Traditional investments include stocks, bonds, and real estate. They offer different growth patterns. Stock prices can rise due to company performance. Bonds provide steady interest returns. Real estate values increase over time.

- Stocks: Higher risk, higher reward

- Bonds: Lower risk, steady returns

- Real Estate: Long-term growth, tangible asset

Bitcoin halving events create scarcity. This can drive prices up. Traditional investments do not have such events. They grow based on economic factors.

Investors should diversify. Holding various assets reduces risk. Bitcoin halving can benefit long-term investors. Combining it with other investments can optimize returns.

Frequently Asked Questions

What Does Bitcoin Halving Mean For Investors?

Bitcoin halving reduces the reward for mining new blocks by half. This decreases supply, potentially increasing Bitcoin’s price. Investors see it as a bullish signal.

What Will Bitcoin Be Worth After The 2024 Halving?

Predicting Bitcoin’s value after the 2024 halving is challenging. Historical trends suggest potential price increases, but market conditions vary.

Will Bitcoin Go Up Or Down After Halving?

Bitcoin’s price after halving is unpredictable. Historically, it often rises, but market conditions vary. Invest wisely and research thoroughly.

Will Bitcoin Be A Good Long Term Investment?

Bitcoin could be a good long-term investment for some. It offers high potential returns but carries significant risk. Research thoroughly before investing.

What Is Bitcoin Halving?

Bitcoin halving is when the reward for mining new blocks is cut in half.

Conclusion

Bitcoin halving events have historically benefited long-term investors. They often lead to price increases due to reduced supply. While past performance isn’t a guarantee, many experts remain optimistic. Long-term investors should stay informed and consider potential benefits. Careful planning and staying updated can help make informed investment decisions.