What is More Profitable, Option Trading Or Forex Trading?

Option trading can be more profitable due to higher leverage and strategic flexibility. Forex trading offers liquidity and 24/7

Option trading can be more profitable due to higher leverage and strategic flexibility. Forex trading offers liquidity and 24/7 market access.

Option trading and Forex trading are two popular financial markets. Each offers unique opportunities and risks. Option trading allows investors to leverage their investments. This can lead to significant profits with relatively small capital. Forex trading, on the other hand, provides unparalleled liquidity and market access at all hours.

Traders can benefit from global currency fluctuations. Both markets require knowledge and strategy. Options are often seen as more complex but potentially more rewarding. Forex trading is straightforward but can be volatile. Understanding your risk tolerance and financial goals is crucial. Choose the market that aligns with your trading style for the best results.

Trading Markets In A Short!

Trading markets offer many ways to make money. Two popular options are Option Trading and Forex Trading. Both have unique features and risks. Let’s dive into the basics to understand which can be more profitable for you.

Overview Of Option Trading

Option trading involves buying and selling options. An option is a contract giving the right to buy or sell an asset at a set price. Options are tied to stocks, indexes, or other assets. They offer flexibility and leverage.

Options come in two types: Calls and Puts. A Call option allows buying an asset at a set price. A Put option allows selling an asset at a set price. Traders use options for speculation or hedging.

| Option Type | Right to Buy/Sell | Use |

|---|---|---|

| Call | Buy | Speculation |

| Put | Sell | Hedging |

Basics Of Forex Trading

Forex Trading involves buying and selling currencies. The forex market is the largest financial market in the world. It operates 24 hours a day, five days a week.

Forex trading pairs two currencies. For example, EUR/USD pairs the Euro with the US Dollar. Traders profit from changes in exchange rates. Leverage in forex trading allows control of large positions with small capital.

- EUR/USD – Euro/US Dollar

- GBP/USD – British Pound/US Dollar

- USD/JPY – US Dollar/Japanese Yen

Forex trading requires understanding global economic events. News and reports can impact currency values. Successful traders use analysis and strategies to predict market movements.

Profit Potential

Understanding the profit potential of option trading and forex trading is crucial. Each trading type offers unique opportunities to earn. This section breaks down the earnings you can expect from both.

Earnings In Option Trading

Option trading allows traders to buy and sell options contracts. These contracts give the right to buy or sell assets at a set price. The profit potential in option trading can be high. It depends on the price movement of the underlying asset. Traders can earn profits by predicting the market direction correctly.

- Potential for high returns

- Control over risk through contracts

- Profit from both rising and falling markets

Option trading also allows leveraging. Leverage can multiply your returns. For example, a small price move can lead to significant profits.

Profits In Forex Trading

Forex trading involves buying and selling currency pairs. The goal is to profit from currency fluctuations. The profit potential in forex trading is also significant. The forex market is the most liquid market in the world. This means traders can enter and exit positions easily.

| Feature | Details |

|---|---|

| High Liquidity | Easy to enter and exit trades |

| Leverage | Amplifies potential profits |

| 24/7 Market | Trade at any time |

Traders can use technical analysis and fundamental analysis to predict market movements. High leverage in forex trading can lead to substantial profits. But it can also increase the risk of significant losses.

Risk Factors

When deciding between option trading and forex trading, understanding the risk factors is crucial. Each type of trading carries unique risks that can affect profitability. In this section, we will explore the risks associated with option trading and forex trading.

Risks In Option Trading

Option trading involves significant risk due to its complex nature. Here are the key risks:

- Time Decay: Options lose value over time, especially as expiration nears.

- Volatility: Market changes can greatly impact option prices.

- Leverage: High leverage can lead to substantial losses.

- Liquidity: Some options may be hard to sell at desired prices.

Risks In Forex Trading

Forex trading also carries its own set of risks. Let’s delve into the primary risks:

- Market Volatility: Forex markets can be highly unpredictable.

- Leverage: High leverage can magnify both gains and losses.

- Interest Rate Risk: Changes in interest rates can affect currency values.

- Liquidity Risk: Some currency pairs may lack sufficient liquidity.

| Risk Factor | Option Trading | Forex Trading |

|---|---|---|

| Time Decay | High | Low |

| Market Volatility | Medium | High |

| Leverage | High | High |

| Liquidity | Variable | Variable |

Cost And Accessibility

Understanding the cost and accessibility of option trading and forex trading is crucial. Both aspects can significantly impact profitability. Let’s dive into the specifics.

Cost Of Option Trading

The cost of option trading includes commissions, fees, and the premium paid for the option. Brokers may charge a fee per trade or a flat rate.

| Cost Type | Description |

|---|---|

| Commissions | Fees paid to brokers for executing trades. |

| Premium | The price paid to buy the option contract. |

| Exercise Fees | Fees charged when exercising the option. |

Accessibility In Forex Trading

Forex trading is accessible to individuals and institutions. Traders can start with a small capital. The forex market operates 24/7, making it highly accessible.

- Small initial investment

- 24/7 market availability

- Global market access

Many brokers offer demo accounts. These accounts allow practice without real money.

Which Is More Profitable?

Traders often ask: Which is more profitable, option trading or forex trading? Both have potential for high returns. The decision depends on various factors. Let’s dive into a detailed comparison.

Comparison Of Returns

Option trading offers flexibility and high leverage. Traders can earn substantial profits with small investments. The potential returns can be immense.

On the other hand, forex trading involves trading currency pairs. It is the most liquid market globally. Traders can leverage up to 50 times their investment. The returns can be significant, but the risks are high.

| Trading Type | Potential Returns | Leverage | Risk Level |

|---|---|---|---|

| Option Trading | High | Moderate | High |

| Forex Trading | High | Very High | Very High |

Factors Influencing Profitability

Several factors influence the profitability of both trading types:

- Market Conditions: Volatile markets can increase profits. But they also increase risk.

- Experience: Experienced traders can navigate complex trades better. They can maximize returns.

- Capital: More capital can enhance leverage. It increases the potential for higher profits.

- Trading Strategy: A well-planned strategy is crucial. It helps in maximizing profitability.

Understanding these factors can help in making an informed decision. Both trading types have their own advantages. Choose based on your risk tolerance and investment goals.

Frequently Asked Questions

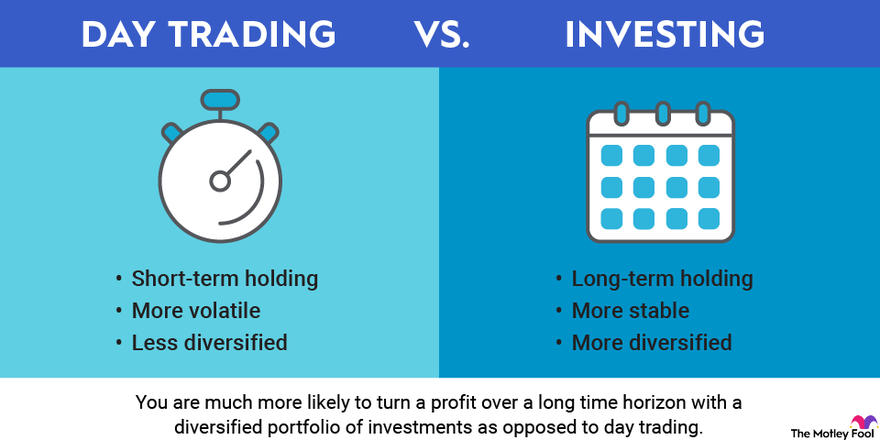

Which Type Of Trading Is Most Profitable?

Day trading can be highly profitable for experienced traders. It offers quick returns on investments.

Which Is Riskier, Options Or Forex?

Options are riskier due to their complexity and potential for unlimited losses. Forex trading risks are high but more predictable.

Is Options Trading The Most Profitable?

Options trading can be highly profitable but also carries significant risk. Success depends on strategy and market knowledge.

What Is More Profitable Than Forex?

Stocks, real estate, and cryptocurrencies can be more profitable than forex. They offer higher returns with strategic investments.

Conclusion

Choosing between option trading and forex trading depends on your financial goals and risk tolerance. Both markets offer unique opportunities and challenges. Educate yourself, develop strategies, and practice disciplined trading. With the right approach, you can find profitability in either market.

Make informed decisions to maximize your trading success.