What are the New Methods of Cyber Fraud in the World of Finance?

New methods of cyber fraud in the finance world include sophisticated phishing attacks and advanced malware. These tactics exploit

New methods of cyber fraud in the finance world include sophisticated phishing attacks and advanced malware. These tactics exploit vulnerabilities in financial systems.

Cyber fraud has evolved significantly in recent years. Cybercriminals now employ more sophisticated techniques to breach financial systems. Phishing attacks have become more targeted, often mimicking legitimate communications. Malware has also advanced, capable of bypassing traditional security measures. These threats pose significant risks to both individuals and institutions.

Staying informed about these methods is crucial. Implementing strong cybersecurity practices can mitigate these risks. Regularly updating software and educating users about potential threats are essential steps. As cyber fraud continues to evolve, vigilance and proactive measures become increasingly important.

Phishing Attacks

Phishing attacks are a major cyber threat. They trick people into giving away sensitive information. Cybercriminals use various methods to carry out phishing. They target personal and financial data.

Email Scams

Email scams are a common type of phishing. Attackers send fake emails that look real. These emails often ask for personal details. They might seem to come from banks or other trusted sources.

Victims may receive emails with urgent messages. They might say your account is locked. These emails often contain links. Clicking on the link can lead to a fake website. This site collects your data.

| Signs of Email Scams | Description |

|---|---|

| Urgent Language | Emails that create a sense of urgency. |

| Strange Links | Links that look suspicious or unfamiliar. |

| Unexpected Attachments | Attachments you did not expect to receive. |

Spear Phishing

Spear phishing is a more targeted form of phishing. Attackers focus on specific individuals. They gather information about their targets. This makes the attack seem more real.

Cybercriminals might use social media to learn about their targets. They then craft personalized emails. These emails are harder to spot as fake. They often contain personal details to gain trust.

Protect yourself by verifying the sender. Check the email address closely. Do not click on suspicious links. Use security software to detect threats.

- Verify the Sender: Check email addresses carefully.

- Do Not Click: Avoid clicking on unknown links.

- Use Security Software: Install programs to detect threats.

Ransomware

Ransomware is a type of cyber fraud. It involves malicious software encrypting data. Victims must pay a ransom to regain access. This method targets individuals and businesses. Understanding its mechanisms can help in prevention.

Data Encryption

Ransomware attacks begin with data encryption. Cybercriminals use malware to lock files. These files become inaccessible to users. The attackers demand payment for a decryption key. Without the key, the data remains locked.

| Step | Description |

|---|---|

| 1 | Malware infiltrates the system. |

| 2 | Files are scanned and encrypted. |

| 3 | Access to data is blocked. |

| 4 | Ransom note is displayed. |

Payment Demands

After encryption, attackers make payment demands. They usually ask for cryptocurrency. Bitcoin is a common choice. The transaction is hard to trace. This keeps the attackers anonymous.

The ransom note often includes:

- Amount demanded

- Payment deadline

- Instructions for payment

If the ransom isn’t paid, the data remains locked. Sometimes, paying doesn’t guarantee data recovery. This makes ransomware a high-risk threat.

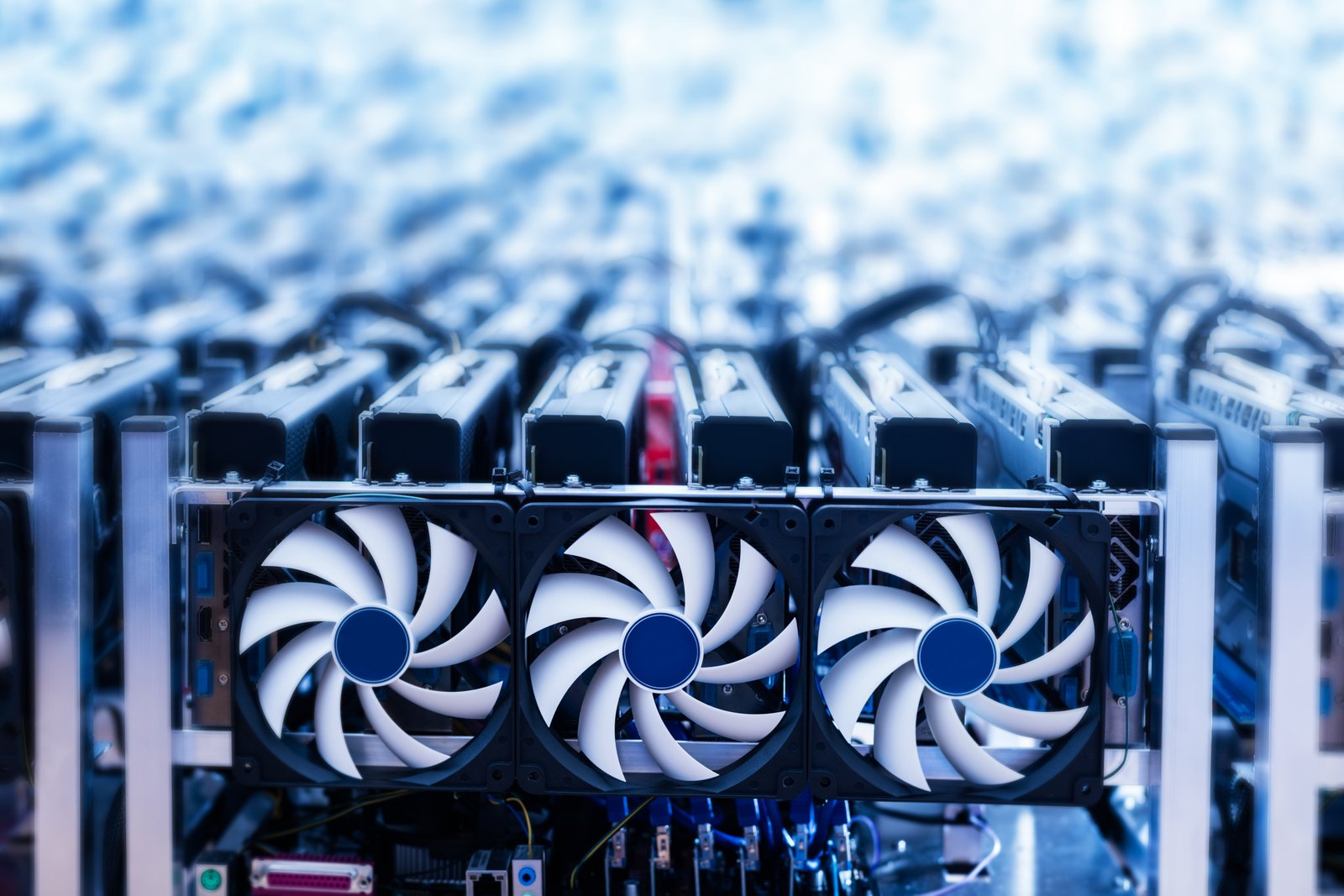

Cryptojacking

In the rapidly evolving world of finance, cyber fraud continues to advance. One of the newest and most insidious methods is Cryptojacking. This form of cyber fraud involves unauthorized use of someone else’s computer to mine cryptocurrencies. Cryptojacking can severely impact both individual users and organizations. Below, we explore its key aspects.

Unauthorized Mining

Cryptojacking works by secretly installing cryptocurrency mining software on a victim’s computer. The software then uses the computer’s resources to mine cryptocurrencies like Bitcoin or Ethereum. This unauthorized mining occurs without the user’s knowledge. It can significantly slow down the computer’s performance.

Hackers often spread the mining software through phishing emails. These emails contain malicious links or attachments. Once clicked, the software installs itself on the victim’s computer. Another common method is through malicious ads on websites. These ads contain scripts that automatically execute mining operations on visitors’ devices.

Energy Consumption

Cryptojacking not only slows down computers but also increases energy consumption. Mining cryptocurrencies requires substantial processing power. This results in higher electricity usage. For businesses, this can lead to increased operational costs.

Users may notice their devices becoming unusually hot or their fans running more frequently. These are signs of increased energy consumption due to unauthorized mining. Over time, the additional wear and tear can also shorten the lifespan of the hardware.

Protecting against Cryptojacking involves using reliable antivirus software and regularly updating your operating system. Awareness and caution when opening emails or clicking on ads are also crucial. By staying informed, you can safeguard your devices and financial well-being.

Social Engineering

Social engineering exploits human psychology to deceive individuals into revealing sensitive information. Cybercriminals employ phishing, pretexting, and baiting to manipulate financial transactions. These sophisticated tactics target vulnerabilities, posing significant risks in the financial sector.

Social engineering is a crafty way to trick people. Cybercriminals use it to steal money or data. They play with human emotions and trust.

This method is getting very popular in financial fraud. Let’s dive into some key tactics they use.

Impersonation

Impersonation is one of the oldest tricks in the book. Fraudsters pretend to be someone else. They can pose as a bank official, a friend, or a family member.

They often use fake emails or phone numbers. They make their messages look real. Their goal is to gain your trust and get sensitive information.

Here are some common impersonation tactics:

- Phishing emails

- Fake phone calls

- Social media messages

Psychological Manipulation

Psychological manipulation is another key method. Cybercriminals exploit human emotions like fear, greed, and curiosity.

They may create a sense of urgency. They might tell you that your bank account is at risk. They trick you into acting quickly without thinking.

Common psychological manipulation tactics include:

- Scare tactics

- Tempting offers

- Fake emergencies

| Method | Description | Common Tactics |

|---|---|---|

| Impersonation | Pretending to be someone else | Phishing emails, fake calls, social media messages |

| Psychological Manipulation | Exploiting human emotions | Scare tactics, tempting offers, fake emergencies |

Stay informed and cautious. Social engineering is a growing threat. Protect your financial information always.

Advanced Persistent Threats

Advanced Persistent Threats (APTs) are a significant danger in the world of finance. These threats are sophisticated and often involve a long-term infiltration. APTs aim to steal sensitive financial data or disrupt operations. Let’s explore two critical aspects of APTs: Long-term Infiltration and Data Exfiltration.

Long-term Infiltration

APTs often involve long-term infiltration. Attackers gain unauthorized access to a network and stay hidden for months or years. They slowly gather information and avoid detection.

These attacks usually start with phishing emails. The emails contain malware that gives attackers access to the network. Once inside, they establish a foothold.

Attackers use various techniques to remain undetected. They exploit software vulnerabilities and use stolen credentials. They often mimic normal network traffic to blend in.

| Technique | Description |

|---|---|

| Phishing Emails | Emails with malicious links or attachments. |

| Exploiting Vulnerabilities | Taking advantage of software weaknesses. |

| Credential Theft | Using stolen usernames and passwords. |

| Blending in | Mimicking normal network traffic. |

Data Exfiltration

The ultimate goal of APTs is data exfiltration. Attackers steal sensitive financial data and transfer it outside the network.

They often use encrypted channels to avoid detection. The stolen data can include personal information, financial records, and intellectual property.

Here are common methods of data exfiltration:

- Encrypted Communication Channels

- Steganography

- USB Devices

- Cloud Storage

APTs are a serious threat to the finance sector. Understanding their methods helps in creating better defenses.

Frequently Asked Questions

What Is Phishing In Finance?

Phishing in finance involves tricking individuals into revealing sensitive financial information through fake emails or websites.

How Do Cybercriminals Use Malware?

Cybercriminals use malware to steal financial data, spy on transactions, or disrupt financial systems.

What Is Identity Theft In Finance?

Identity theft in finance occurs when criminals use stolen personal information to access financial accounts.

How Does Social Engineering Affect Finance?

Social engineering manipulates individuals into divulging confidential information, leading to financial fraud or unauthorized transactions.

Conclusion

Cyber fraud in finance is constantly evolving. Staying informed and vigilant is crucial. Implementing robust security measures can protect your financial data. Regular updates and awareness are key to combating new fraud methods. Prioritize cybersecurity to safeguard your assets and ensure peace of mind.

Stay proactive and secure your financial future.