If There No Forex Exchange, How is It Possible to Do HFTS on That Market?

Without a forex exchange, conducting high-frequency trading (HFT) on that market is impossible. HFT relies on real-time data and

Without a forex exchange, conducting high-frequency trading (HFT) on that market is impossible. HFT relies on real-time data and liquidity.

High-frequency trading (HFT) is a sophisticated form of trading that relies on speed and precision. It involves executing numerous trades within fractions of a second. Forex, or foreign exchange, is a decentralized market where currencies are traded. It provides the necessary liquidity and real-time data essential for HFT.

Without a forex exchange, there is no centralized platform to offer these critical components. This makes it impossible to implement HFT strategies effectively. Traders need access to rapid and accurate information to capitalize on small price movements. Hence, the existence of a forex exchange is crucial for HFT operations.

:max_bytes(150000):strip_icc()/market-risk.asp-Final-267d57db9f87429cb80051c8a5132847.jpg)

The Role Of Forex In Global Markets

The Forex market plays a crucial role in global finance. It allows countries to trade their currencies. This trading supports international trade and investment. Without Forex, high-frequency trading (HFT) would face significant challenges. HFT relies on fast transactions and liquidity. Forex provides this liquidity.

Importance Of Currency Trading

Currency trading helps stabilize exchange rates. It balances supply and demand for different currencies. Traders buy and sell currencies based on economic indicators. This activity helps predict future currency movements. Central banks also use Forex to control inflation and stabilize their currency.

Impact On Global Economy

The Forex market impacts the global economy in multiple ways. It influences interest rates, which affect loans and savings. Forex also impacts international trade. Companies need to exchange currencies to buy and sell goods overseas. This process involves currency conversion, which Forex facilitates.

| Factor | Impact on Economy |

|---|---|

| Interest Rates | Influence loans and savings |

| International Trade | Facilitates buying and selling goods |

| Economic Indicators | Predict future currency movements |

Without Forex, HFT would lack the necessary liquidity. HFT requires quick buying and selling. Forex provides the platform for these rapid transactions. Thus, Forex is essential for both trading and the global economy.

High-Frequency Trading Explained

High-Frequency Trading (HFT) is a method used in financial markets. It involves executing a large number of orders at extremely high speeds. HFT uses powerful computers to transact on the market in fractions of a second.

Basics Of HFT

HFT relies on complex algorithms. These algorithms analyze multiple markets and execute orders based on market conditions. The goal is to make a profit from small price changes.

- Traders use algorithms to make decisions.

- Transactions happen in milliseconds.

- It involves high volumes of trades.

HFT operates on tiny margins. Small profits per trade add up to significant gains. Speed and volume are key in HFT.

Technological Requirements

HFT requires advanced technology. Powerful computers and fast internet connections are essential. These tools help execute trades faster than competitors.

| Requirement | Description |

|---|---|

| High-Speed Computers | Perform rapid calculations and execute trades. |

| Low Latency Networks | Ensure fast data transmission and order execution. |

| Advanced Algorithms | Analyze market data and make trading decisions. |

Software engineers and data scientists design these systems. They ensure the trading process is as efficient as possible.

Without a forex exchange, traditional HFT methods face challenges. Traders may need alternative markets or innovative strategies.

Challenges Without Forex Exchange

Forex exchange platforms play a crucial role in high-frequency trading (HFT). Without them, traders face significant challenges. These challenges can disrupt the efficiency and profitability of HFT strategies.

Liquidity Issues

Liquidity ensures smooth transactions in the forex market. Without a forex exchange, liquidity would drop dramatically. Traders would struggle to find counterparties for their trades. This could lead to longer transaction times.

Here are some potential liquidity issues:

- Higher transaction costs

- Delayed order execution

- Increased slippage

These factors could make HFT less viable. Traders may face more risks and uncertainties.

Market Volatility

Forex exchanges help stabilize the market. Without them, market volatility would increase. Prices would fluctuate more, making it hard to predict trends.

Consider these aspects of increased volatility:

- Erratic price movements

- Higher risk of loss

- Reduced market confidence

Traders would need to adapt quickly to these changes. This instability could deter many from engaging in HFT.

In conclusion, without a forex exchange, HFT faces significant challenges. Liquidity issues and market volatility are major concerns. These factors could make HFT less profitable and more risky.

Alternative Markets For HFT

High-Frequency Trading (HFT) has transformed financial markets, offering speed and efficiency. But what if there was no Forex exchange? Traders would need alternative markets to apply their strategies. Let’s explore some potential options.

Cryptocurrency Exchanges

Cryptocurrency exchanges provide a fertile ground for HFT. These platforms offer 24/7 trading, which means opportunities are always available. Liquidity is a significant factor, and many exchanges have deep order books. This is crucial for HFT strategies.

Another advantage is the volatility of cryptocurrencies. High volatility creates numerous price discrepancies, perfect for HFT. Additionally, the lack of centralized regulation offers more freedom for algorithmic trading strategies.

- 24/7 trading opportunities

- High liquidity

- Significant volatility

- Freedom for algorithmic strategies

Stock Markets

The stock market is another viable alternative for HFT. Exchanges like NASDAQ and NYSE offer high liquidity and large volumes. These features are essential for executing trades quickly. Stock markets also provide a wide range of assets to trade, from large-cap stocks to ETFs.

Another benefit is the availability of extensive historical data. This allows traders to backtest their algorithms effectively. Moreover, stock markets are highly regulated, ensuring a level playing field for all participants.

- High liquidity and volumes

- Wide range of tradable assets

- Extensive historical data

- Regulated environment

Future Prospects

The world of High-Frequency Trading (HFT) is fast-changing. If there were no forex exchange, how would HFTs adapt? Let’s explore the future possibilities.

Technological Innovations

Technological innovations could pave the way for HFTs to thrive. Blockchain technology offers a decentralized trading platform. This can replace traditional forex exchanges.

Artificial Intelligence (AI) can enhance trading algorithms. These AI-driven algorithms can predict market trends accurately.

Here are some potential tech innovations:

- Quantum computing for faster data processing.

- Blockchain for secure, decentralized trading.

- AI for smarter trading algorithms.

Regulatory Changes

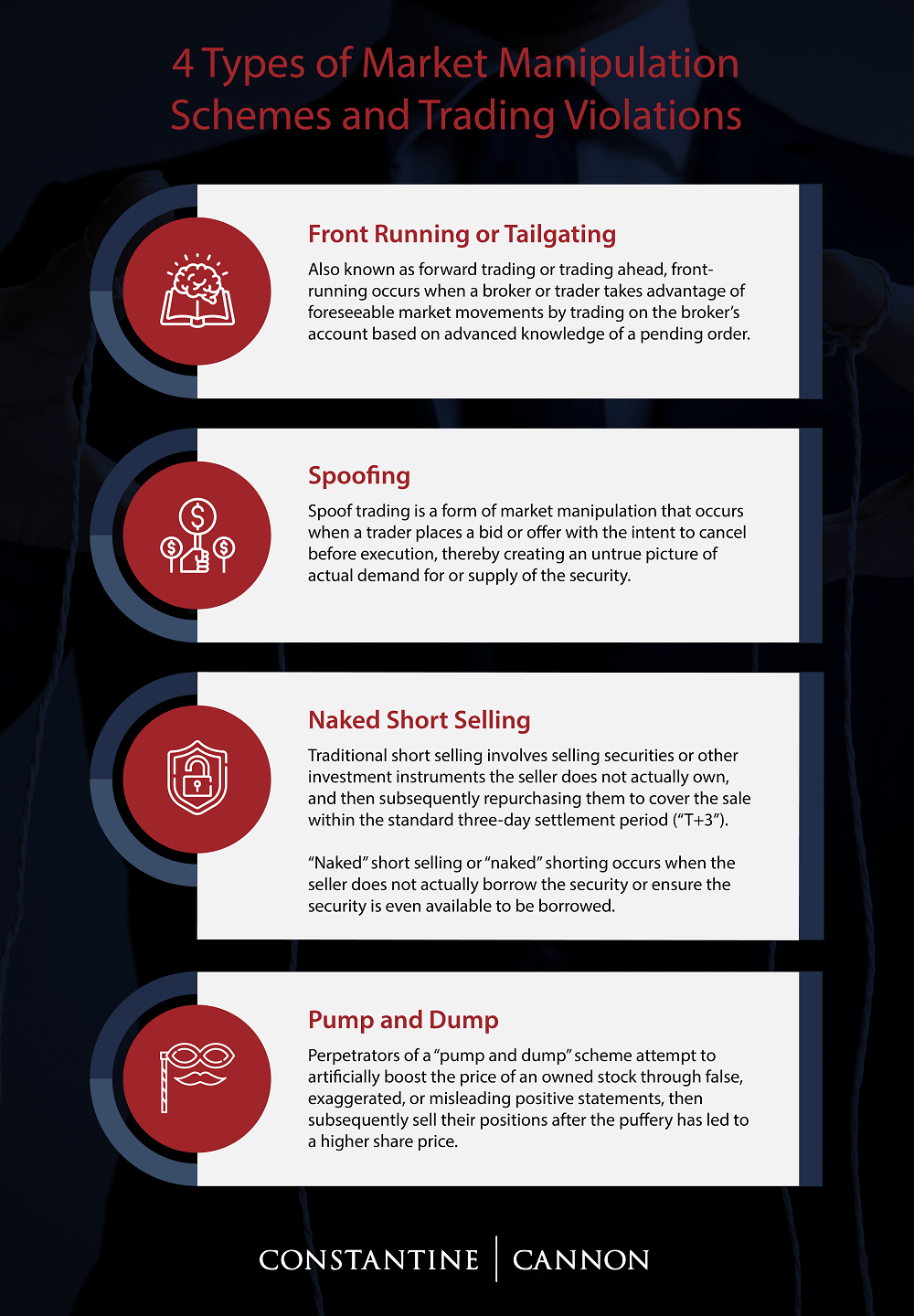

Regulatory changes are crucial for the future of HFTs. Without a forex exchange, new regulations will emerge. These regulations can ensure fair trading practices.

Global cooperation among regulators can create a unified framework. This helps in maintaining market stability.

Potential regulatory changes include:

- Decentralized market regulations to ensure security.

- Transparency laws to prevent market manipulation.

- Global cooperation for unified trading standards.

Here is a comparison of current and future regulations:

| Current Regulations | Future Regulations |

|---|---|

| Centralized oversight | Decentralized oversight |

| Limited transparency | Enhanced transparency |

| National regulations | Global regulations |

Frequently Asked Questions

Is It Possible To Do High-frequency Trading From Home?

Yes, high-frequency trading from home is possible. You’ll need advanced software, powerful hardware, and a fast internet connection.

Is Hft Legal In The Usa?

Yes, high-frequency trading (HFT) is legal in the USA. It is regulated by the Securities and Exchange Commission (SEC). Compliance with regulations is mandatory for firms engaging in HFT activities.

Do High Frequency Traders Still Exist?

Yes, high frequency traders still exist. They use advanced algorithms to execute trades in milliseconds. These traders seek to profit from small price discrepancies and market inefficiencies. High frequency trading remains a significant part of modern financial markets.

Can You Use Hft On Live Accounts?

Yes, you can use High-Frequency Trading (HFT) on live accounts. Ensure your broker supports HFT and complies with regulations.

Conclusion

The absence of a forex exchange makes HFTs challenging but not impossible. Advanced algorithms and private networks provide solutions. Traders adapt using innovative technologies, ensuring market efficiency. Continuous evolution in financial technology keeps HFTs viable. Staying informed and flexible is crucial for success in this dynamic environment.