How Do Forex Exchange Reserves Effect the Value of a Currency?

Forex exchange reserves influence the value of a currency by affecting its supply and demand. High reserves can stabilize

Forex exchange reserves influence the value of a currency by affecting its supply and demand. High reserves can stabilize and strengthen a currency.

Forex exchange reserves, held by central banks, are crucial for a country’s economic stability. These reserves include foreign currencies, gold, and other financial assets. Central banks use them to manage exchange rates and maintain liquidity. High reserves can boost investor confidence, leading to a stronger currency.

Conversely, low reserves can signal economic trouble, devaluing the currency. Reserves also help in managing inflation and ensuring smooth international trade. Effective management of these reserves is vital for sustaining a stable and strong currency. Understanding forex reserves can provide insights into a country’s economic health.

Forex Exchange Reserves Overview

Forex exchange reserves play a crucial role in the economy. They are essential for maintaining the stability of a country’s currency. Understanding these reserves helps to grasp their impact on currency value.

Definition And Purpose

Forex exchange reserves are assets held by a central bank. These include foreign currencies, gold, and special drawing rights (SDRs). The main purpose is to support the country’s currency value. They also ensure smooth international trade.

Central banks use these reserves to influence exchange rates. They can buy or sell their own currency in the forex market. This helps stabilize the currency value during economic volatility. Reserves also serve as a buffer against financial crises.

Historical Context

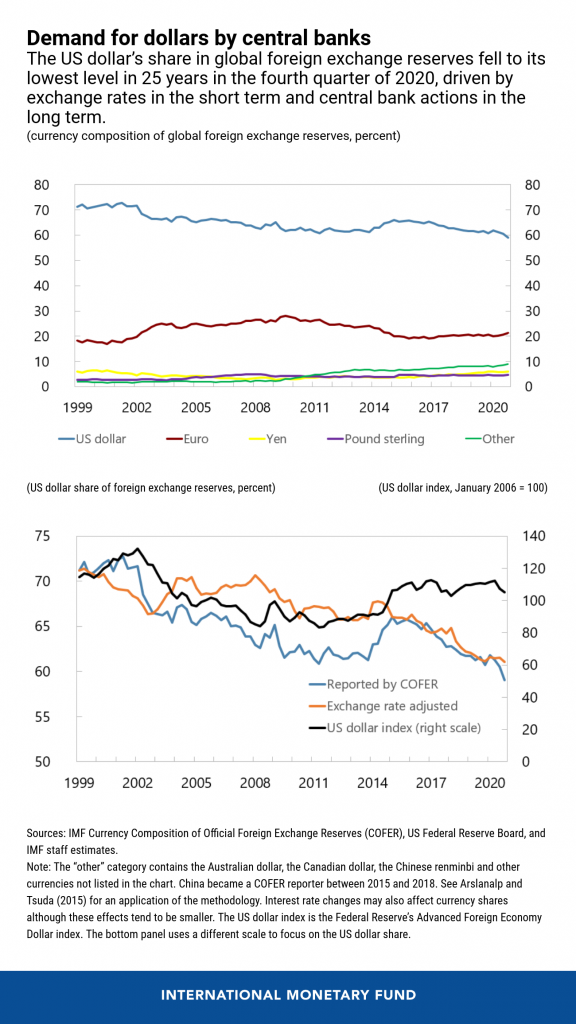

The history of forex reserves dates back to ancient times. Countries have always held reserves for trade and security. The modern system evolved after World War II. The Bretton Woods Agreement established the US dollar as the global reserve currency.

This system required countries to maintain reserves in US dollars. It helped stabilize the global economy. The system changed in 1971 when the US ended gold convertibility. Since then, countries have diversified their reserves.

Today, forex reserves include multiple currencies. The US dollar still dominates, but the euro, yen, and other currencies are also significant.

Factors Influencing Reserves

Understanding the factors influencing forex exchange reserves is crucial for currency value. These reserves help maintain stability and influence economic decisions. Let’s explore key factors that impact these reserves.

Trade Balance

The trade balance is the difference between a country’s exports and imports. A positive trade balance means more exports than imports. This increases forex reserves. Conversely, a negative trade balance reduces reserves.

For example, if a country exports $100 billion and imports $80 billion, the trade balance is +$20 billion. This surplus boosts forex reserves.

Conversely, if imports exceed exports, forex reserves deplete. This can weaken the currency value.

Foreign Investment

Foreign investment plays a significant role in influencing forex reserves. When foreign investors buy assets, they convert their currency to the local currency. This increases forex reserves.

There are two main types of foreign investments:

- Foreign Direct Investment (FDI): Investment in physical assets like factories.

- Portfolio Investment: Investment in financial assets like stocks and bonds.

Both types boost reserves, strengthening the currency.

For instance, if a foreign company builds a factory, they need local currency. This transaction adds to the forex reserves.

| Factor | Impact on Reserves |

|---|---|

| Positive Trade Balance | Increases Reserves |

| Negative Trade Balance | Decreases Reserves |

| Foreign Direct Investment | Increases Reserves |

| Portfolio Investment | Increases Reserves |

Maintaining healthy forex reserves is essential for economic stability. It helps in managing the currency value effectively.

Impact On Currency Value

Forex exchange reserves play a crucial role in determining the value of a currency. These reserves include foreign currencies, gold, and other assets held by a central bank. They help to stabilize the currency and manage economic policy. Let’s explore how forex reserves impact currency value through currency stability and inflation control.

Currency Stability

Forex reserves help maintain currency stability. Central banks use these reserves to intervene in foreign exchange markets. If a currency’s value drops too quickly, the central bank can sell foreign reserves to buy its own currency. This increases demand for the domestic currency, boosting its value.

Conversely, if the currency’s value rises too fast, the central bank can buy foreign assets. This action releases more of the domestic currency into the market, reducing its value. This balancing act helps keep the currency stable, avoiding wild swings in value.

| Action | Effect on Currency |

|---|---|

| Selling foreign reserves | Increases currency value |

| Buying foreign assets | Decreases currency value |

Inflation Control

Forex reserves also aid in inflation control. High inflation erodes the value of money, making goods more expensive. Central banks can use forex reserves to manage inflation rates. By controlling the money supply, they can keep inflation in check.

For example, if inflation is high, the central bank can sell foreign reserves. This reduces the money supply, helping to lower inflation. Conversely, if inflation is low, the bank can buy foreign assets to increase the money supply, stimulating the economy.

- High inflation: Sell foreign reserves to reduce money supply.

- Low inflation: Buy foreign assets to increase money supply.

In both cases, the central bank uses forex reserves to maintain economic stability. This ensures the currency retains its value over time.

Central Bank Interventions

Central banks play a crucial role in managing a country’s forex exchange reserves. Their interventions can significantly impact the value of a currency. This section explains how central banks use various tools to influence currency value.

Market Operations

Central banks often engage in market operations to stabilize their currency. They buy or sell large amounts of their own currency. This action affects the supply and demand dynamics.

For example, if a central bank sells its currency, the supply increases. This causes the value to drop. Conversely, buying the currency reduces supply, boosting its value.

These operations can be done openly or covertly. Open interventions are public and can send strong signals to the market. Covert operations are less noticeable but can still influence currency value.

Policy Decisions

Policy decisions by central banks also affect currency value. Interest rate changes are a common tool. Raising interest rates can attract foreign investment, increasing currency demand.

Lowering interest rates can have the opposite effect. Central banks may also change reserve requirements for commercial banks. Higher reserve requirements reduce the money supply, potentially increasing currency value.

Other policies include altering foreign exchange reserves. Holding more foreign currency can stabilize the local currency. Selling foreign reserves can provide liquidity and stabilize markets.

Here’s a summary of central bank interventions:

| Intervention Tool | Effect on Currency Value |

|---|---|

| Buying Local Currency | Increases Value |

| Selling Local Currency | Decreases Value |

| Raising Interest Rates | Increases Value |

| Lowering Interest Rates | Decreases Value |

| Changing Reserve Requirements | Varies |

Global Examples

Understanding how forex exchange reserves affect the value of a currency can be complex. Examining global examples can make this clearer. Let’s explore how developed economies and emerging markets manage their reserves and the impact on their currencies.

Developed Economies

Developed economies like the USA and Japan hold large forex reserves. These reserves help stabilize their currencies. For instance, the US Dollar is a global reserve currency. The US holds substantial forex reserves to maintain its value. Japan uses its reserves to manage the Yen’s exchange rate. This helps keep their currency strong against others.

| Country | Forex Reserves (in billion USD) | Currency Impact |

|---|---|---|

| USA | 123.3 | Stabilizes USD |

| Japan | 1372.1 | Stabilizes Yen |

Emerging Markets

Emerging markets also use forex reserves to stabilize their currencies. Countries like India and Brazil hold significant reserves. These reserves protect their currencies from volatility. For instance, India holds reserves to manage the Rupee’s value. Brazil uses its reserves to support the Real during economic stress.

- India: Forex reserves help stabilize the Rupee.

- Brazil: Reserves support the Real during economic crises.

Emerging markets often face more currency volatility. Their forex reserves play a crucial role in economic stability.

:max_bytes(150000):strip_icc()/currency-peg.asp-final-fe79e540257844c99bf1fd4357f40a67.png)

Frequently Asked Questions

Do Sales Of Foreign Exchange Reserves Lead To Currency Appreciation?

Yes, selling foreign exchange reserves can lead to currency appreciation. This reduces the supply of the domestic currency.

What Are The Advantages Of High Forex Reserves?

High forex reserves stabilize the currency, enhance investor confidence, and provide a buffer against economic crises. They also facilitate international trade and help manage inflation effectively.

How Does The Us Benefit From Being The Reserve Currency?

The US benefits from being the reserve currency through lower borrowing costs, increased global demand for the dollar, and enhanced economic influence.

What Role Does Currency Reserves Play In The Balance Of Payments?

Currency reserves help stabilize a country’s currency value. They support international trade and meet foreign debt obligations. Reserves also enhance investor confidence and manage economic crises.

Conclusion

Understanding forex exchange reserves is crucial. They influence a currency’s stability and value. Countries manage reserves to stabilize their economy. High reserves often boost investor confidence. Low reserves can lead to economic challenges. Monitoring these reserves helps predict currency fluctuations.

Stay informed to make smarter financial decisions.