What are the Differences between Investment And Financing?

Investment involves allocating resources to generate future returns, while financing refers to obtaining funds to support business activities. Both

Investment involves allocating resources to generate future returns, while financing refers to obtaining funds to support business activities. Both are crucial but serve different purposes.

Investment is the process of committing money or capital to an endeavor with the expectation of obtaining an additional income or profit. It can include purchasing stocks, bonds, real estate, or starting a business. Effective investment strategies can lead to significant wealth accumulation over time.

Financing, on the other hand, is about acquiring funds needed for various business operations. This can involve taking loans, issuing bonds, or selling equity. Understanding the differences between investment and financing helps businesses and individuals make informed financial decisions, ensuring they strategically grow their wealth while managing necessary funds.

Definition And Purpose

Understanding the differences between investment and financing is crucial. These concepts play essential roles in business and personal finances. While both involve money, their definitions and purposes vary significantly.

Investment Basics

An investment involves putting money into an asset. The goal is to earn a return or profit. Investments can include stocks, real estate, or bonds. The purpose is to grow wealth over time. Investors expect their investments to increase in value.

Financing Basics

Financing refers to obtaining funds to support a project or business. This can be through loans, equity, or other financial instruments. The main purpose is to provide the necessary capital. Financing is often used to start or expand a business. It involves borrowing money, which must be repaid, often with interest.

| Aspect | Investment | Financing |

|---|---|---|

| Definition | Putting money into assets | Obtaining funds for projects |

| Purpose | Grow wealth over time | Provide necessary capital |

| Examples | Stocks, Real Estate, Bonds | Loans, Equity |

Sources Of Funds

Understanding the sources of funds is crucial. It helps you know where money comes from. Both investment and financing have different sources.

Investment Sources

Investment sources are places where you can get money to invest. These funds are used to buy assets or start projects. Here are some common investment sources:

- Personal Savings: Money saved from your income.

- Equity Financing: Selling shares of your company.

- Venture Capital: Funds from investors for startups.

- Government Grants: Money given by the government.

Financing Sources

Financing sources are ways to get money to fund your business or project. This money can be used to cover operational costs or expand. Here are some common financing sources:

- Bank Loans: Money borrowed from a bank.

- Bonds: Debt securities issued by a company.

- Line of Credit: Money you can borrow up to a limit.

- Trade Credit: Buying goods now and paying later.

Risk And Return

Understanding the differences between investment and financing involves examining the concepts of risk and return. Both processes aim to generate wealth but involve different levels and types of risk. This section explores these differences to help you make informed decisions.

Investment Risk

Investment risk refers to the potential for losing money on an investment. Different assets have varying levels of risk. Stocks, for example, are riskier than bonds. The higher the risk, the higher the potential return. Investors need to diversify their portfolios to manage risk effectively.

| Asset Type | Risk Level | Potential Return |

|---|---|---|

| Stocks | High | High |

| Bonds | Medium | Medium |

| Savings Account | Low | Low |

Financing Risk

Financing risk involves the potential for a company to default on its loans. This risk is higher if the company has unstable revenue streams. Creditors assess a company’s financial health before offering loans. Higher interest rates often accompany higher financing risks.

- High debt levels increase financing risk.

- Unstable income makes loan repayment harder.

- Credit ratings affect loan terms and interest rates.

Both investment and financing risks need careful management. Understanding these risks helps in making better financial decisions.

Decision-making Process

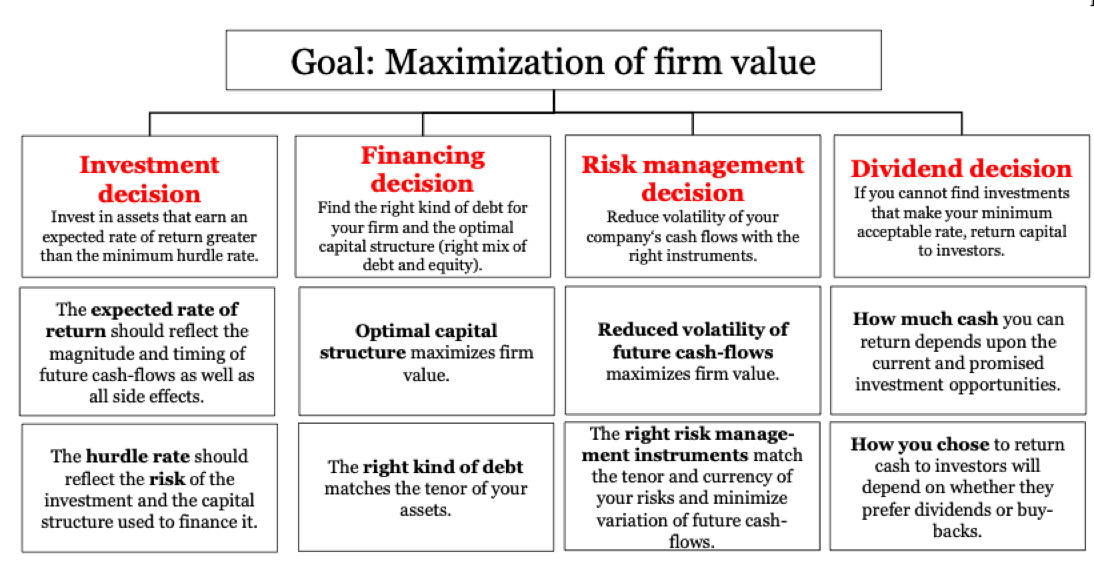

The decision-making process is crucial in both investment and financing. These decisions impact a company’s financial health. Understanding these differences helps optimize resources.

Investment Decisions

Investment decisions involve allocating resources to different opportunities. Companies must decide where to put their money. This can include new projects, assets, or ventures.

Key considerations in investment decisions:

- Expected returns: How much profit will the investment generate?

- Risk assessment: What are the potential risks involved?

- Time horizon: How long will it take to see returns?

- Strategic fit: Does the investment align with company goals?

Good investment decisions can increase a company’s value. Bad decisions can lead to losses.

Financing Decisions

Financing decisions determine how to raise capital. Companies need funds for various activities. These decisions involve choosing the best funding sources.

Key considerations in financing decisions:

- Cost of capital: What is the cost of borrowing or issuing equity?

- Capital structure: What is the mix of debt and equity?

- Cash flow: How will the financing impact cash flow?

- Control: Will the financing dilute ownership or control?

Effective financing decisions ensure a company has the funds needed. Poor financing decisions can strain resources.

Impact On Financial Statements

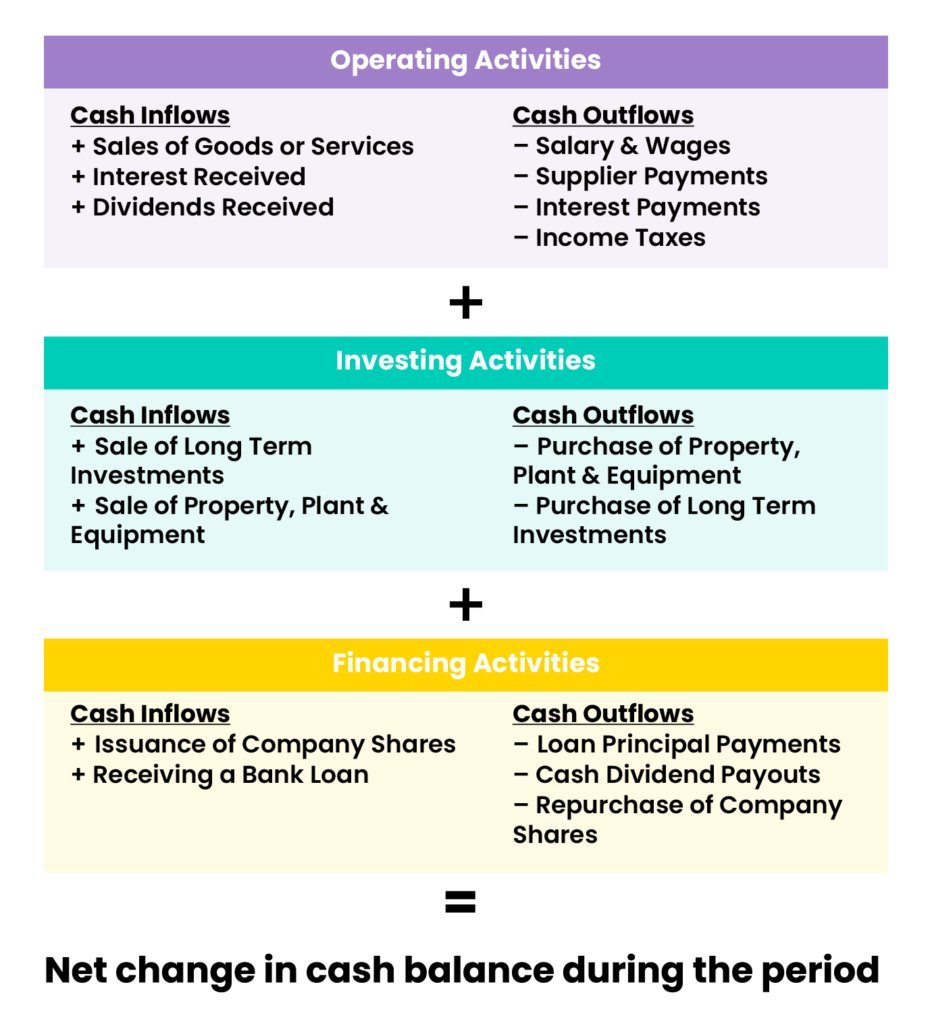

Understanding the impact of investments and financing on financial statements is crucial. These elements shape how a business reports its financial health. Here, we explore their distinct influences.

Investment Impact

Investments affect the balance sheet and income statement. They appear as assets and generate revenue or losses.

- Balance Sheet: Investments increase the asset section.

- Income Statement: Investments generate interest or dividends.

- Cash Flow Statement: Investments impact the cash flow from investing activities.

| Financial Statement | Investment Impact |

|---|---|

| Balance Sheet | Increases assets |

| Income Statement | Generates revenue |

| Cash Flow Statement | Shows cash outflow |

Financing Impact

Financing affects the liabilities and equity sections of the balance sheet. It also influences the cash flow statement.

- Balance Sheet: Financing increases liabilities or equity.

- Income Statement: Financing costs appear as interest expense.

- Cash Flow Statement: Financing impacts the cash flow from financing activities.

| Financial Statement | Financing Impact |

|---|---|

| Balance Sheet | Increases liabilities or equity |

| Income Statement | Shows interest expense |

| Cash Flow Statement | Shows cash inflow |

Frequently Asked Questions

What Is The Difference Between Investment And Financing?

Investment involves allocating funds to assets for potential future returns. Financing entails acquiring funds through loans or equity to support business activities.

What Is The Difference Between A Financing And Investing Activity?

Financing activities involve raising funds through debt or equity. Investing activities focus on purchasing assets like stocks or property.

What Is The Difference Between Finance And Investment Management?

Finance involves managing money, including budgeting, saving, and borrowing. Investment management focuses on growing wealth through asset allocation and portfolio management.

What Is The Difference Between Investor And Financier?

An investor provides capital expecting returns over time. A financier offers short-term funds, often for specific projects or needs.

Conclusion

Understanding the differences between investment and financing is crucial for financial planning. Investment focuses on asset growth, while financing involves sourcing funds. Both play vital roles in business success. Grasping these concepts helps make informed decisions. Enhance your financial literacy to optimize both investment and financing strategies for long-term prosperity.