Can Crypto Trading Replace Traditional Trading?

Crypto trading cannot fully replace traditional trading. Both have unique attributes and serve different market needs. Cryptocurrencies offer a

Crypto trading cannot fully replace traditional trading. Both have unique attributes and serve different market needs.

Cryptocurrencies offer a decentralized, digital-first approach to trading, appealing to tech-savvy investors. Traditional trading, encompassing stocks, bonds, and commodities, has long-established regulatory frameworks and institutional trust. Crypto trading operates 24/7 and offers high volatility, potentially leading to significant gains or losses.

Traditional markets follow standard operating hours and tend to be more stable. Each trading method provides distinct opportunities and risks. Investors often diversify across both to balance their portfolios. Understanding the strengths and limitations of each can help in making informed trading decisions. While crypto trading grows, traditional trading remains a cornerstone of global finance.

Introduction To Crypto Trading

Cryptocurrency trading has become a global phenomenon. This new market offers unique opportunities and challenges. Unlike traditional trading, it operates 24/7. But what exactly is crypto trading?

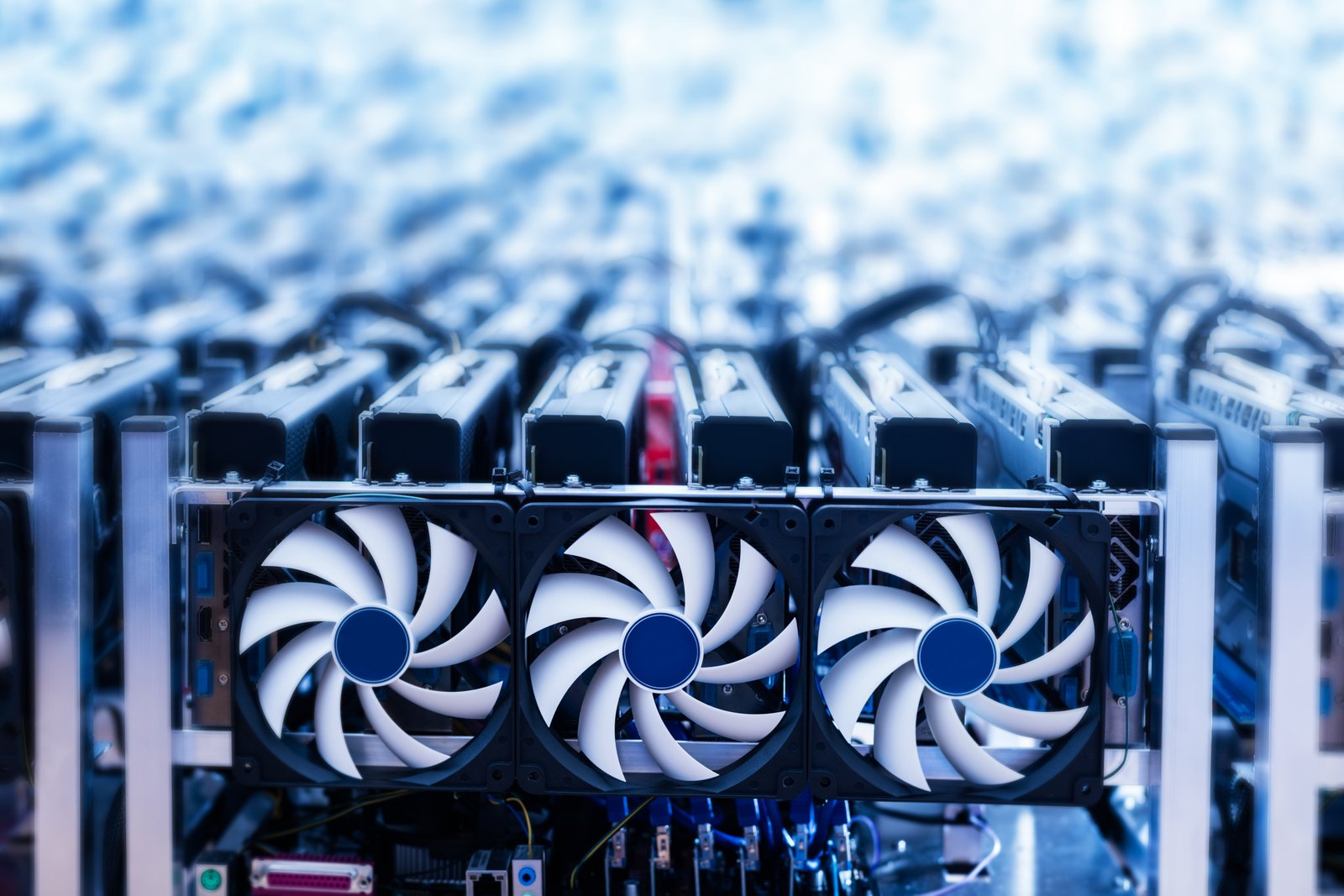

Crypto Market Basics

The crypto market operates on blockchain technology. This decentralized system ensures transparency and security. Major cryptocurrencies include Bitcoin, Ethereum, and Ripple. Traders buy and sell these assets on exchanges.

There are two main types of exchanges:

- Centralized Exchanges (CEX): These platforms are managed by companies. Popular examples are Binance and Coinbase.

- Decentralized Exchanges (DEX): These platforms operate without a central authority. Examples include Uniswap and PancakeSwap.

In the crypto market, traders can engage in:

- Spot Trading: Buying and selling actual cryptocurrencies.

- Margin Trading: Borrowing funds to trade larger amounts.

- Futures Trading: Contracts to buy or sell at a future date.

Key Differences From Traditional Trading

Crypto trading differs significantly from traditional trading. Here are some key differences:

| Aspect | Crypto Trading | Traditional Trading |

|---|---|---|

| Market Hours | 24/7 | Limited Hours |

| Regulation | Lightly Regulated | Heavily Regulated |

| Volatility | High | Moderate |

| Assets | Digital Currencies | Stocks, Bonds, Commodities |

Crypto trading offers higher volatility. This can lead to significant gains or losses. Traditional trading usually involves more stable assets. Stocks, bonds, and commodities are common examples.

Another key difference is regulation. The crypto market is lightly regulated. This can attract both opportunities and risks. Traditional markets are heavily regulated. This provides more security but can limit potential gains.

The market hours also differ. Crypto trading is available 24/7. Traditional trading follows specific market hours. This difference offers flexibility for crypto traders.

Pros Of Crypto Trading

Crypto trading offers several unique advantages over traditional trading. These benefits make it an attractive option for investors. This section will explore some key benefits.

Decentralization Benefits

One major benefit of crypto trading is decentralization. Unlike traditional markets, no central authority controls the crypto market. This means that no single entity can manipulate it easily. Investors have more control over their assets. They can also trade without restrictions from central banks or governments.

Decentralization also ensures greater transparency. All transactions are recorded on a public ledger called the blockchain. This reduces the risk of fraud and corruption. Additionally, decentralization provides more security. It is harder for hackers to target a single point of failure.

24/7 Market Access

Another significant advantage is that the crypto market operates 24/7. Traditional stock markets have specific trading hours. Crypto markets, however, are open all the time. This allows traders to react quickly to market changes. They can trade at any hour, from anywhere in the world.

This constant market access provides more opportunities. Traders can make decisions based on real-time data. There is no need to wait for the market to open. This is especially beneficial for those in different time zones. It also allows for more flexible trading strategies.

| Advantages | Crypto Trading | Traditional Trading |

|---|---|---|

| Market Hours | 24/7 | Limited |

| Control | Decentralized | Centralized |

| Transparency | High | Medium |

| Security | High | Medium |

In summary, crypto trading offers significant advantages. Decentralization and 24/7 market access are key benefits. These features make crypto trading an attractive option for many investors.

Cons Of Crypto Trading

Crypto trading has gained popularity. But it has its downsides. Understanding the cons is crucial for informed decisions.

Volatility Risks

Cryptocurrencies are known for their extreme volatility. Prices can swing wildly in minutes. This makes predicting trends hard.

For example, Bitcoin’s price can jump or drop by 10% in a day. Such rapid changes can lead to significant losses. Unlike traditional assets, crypto lacks stability.

The volatile nature of crypto can be both a blessing and a curse. Traders can earn big but also lose everything quickly. This unpredictability makes it risky.

Regulatory Challenges

Crypto trading faces many regulatory challenges. Governments worldwide are still figuring out how to regulate it. This leads to uncertainty.

Some countries ban or restrict crypto trading. Others impose strict regulations. This creates a complex environment for traders.

The lack of clear rules can lead to sudden changes. These changes can impact the market and your investments. Navigating this landscape requires constant vigilance.

| Country | Regulation Status |

|---|---|

| USA | Regulated with strict rules |

| China | Ban on crypto trading |

| Japan | Legal with regulations |

Regulatory issues can affect the future of crypto. It’s essential to stay updated on the latest regulations.

Traditional Trading Strengths

Traditional trading remains a cornerstone in the financial world. It has several strengths that make it a reliable option for many investors. These strengths offer stability and security that are often unmatched.

Established Frameworks

Traditional trading operates within well-established frameworks. These frameworks have developed over decades. They ensure a high level of predictability and order. Investors can rely on these structures for consistency.

| Framework Type | Description |

|---|---|

| Regulatory Bodies | Entities like the SEC provide oversight and regulation. |

| Market Mechanisms | Stock exchanges have structured trading rules and systems. |

| Financial Instruments | Established assets like stocks, bonds, and mutual funds. |

Investor Protections

Investor protections in traditional trading are robust. These protections are designed to safeguard investor interests. Regulatory bodies enforce strict rules to prevent fraud.

- Regulatory Oversight: Agencies like the SEC monitor trading activities.

- Insurance Schemes: Programs like SIPC protect investor assets.

- Dispute Resolution: Established mechanisms resolve conflicts fairly.

These protections create a safe trading environment. Investors can trade with confidence, knowing there are safeguards. This security is a major strength of traditional trading.

Future Of Trading

The future of trading is a hot topic today. The rise of crypto trading has people asking: Can it replace traditional trading? Let’s explore this by looking at integration possibilities and potential market shifts.

Integration Possibilities

Crypto trading platforms and traditional trading systems could merge. This would offer more choices to traders. Imagine a single platform where you can trade stocks, bonds, and cryptocurrencies. Such integration would simplify the trading process.

Integration also means better technology and tools. Traditional platforms could adopt blockchain technology. This would enhance security and transparency. A combined system could offer real-time data and advanced analytics. This helps traders make better decisions.

| Feature | Traditional Trading | Crypto Trading |

|---|---|---|

| Platform | Stock Exchanges | Crypto Exchanges |

| Security | Moderate | High (with blockchain) |

| Transaction Speed | Slow | Fast |

| Market Hours | Limited | 24/7 |

Potential Market Shifts

Crypto trading could lead to new market dynamics. Traditional markets could see increased competition. This could result in lower fees and better services.

Young investors prefer crypto trading. They find it more accessible and exciting. This shift could drive more traditional investors to explore cryptocurrencies.

A global market is another possibility. Crypto trading is not limited by geography. This could lead to a more interconnected and vibrant trading ecosystem.

Overall, these shifts could create a more inclusive and dynamic market. Both traditional and crypto traders could benefit from this evolution.

Frequently Asked Questions

Will Cryptocurrency Replace Traditional Money?

Cryptocurrency might not completely replace traditional money soon. Both systems could coexist, serving different needs and preferences.

Is Cryptocurrency A Viable Alternative To Traditional Forms Of Currency?

Cryptocurrency can be a viable alternative to traditional currency. It offers decentralization, lower transaction fees, and faster transfers. However, it faces volatility and regulatory challenges.

Is Crypto Trading The Same As Trading?

Crypto trading differs from traditional trading. It involves digital currencies, operates 24/7, and lacks centralized regulation.

Can You Make $100 A Day With Crypto?

Yes, making $100 a day with crypto is possible. It requires market knowledge, strategy, and risk management. Always invest wisely.

Conclusion

Crypto trading presents exciting opportunities but comes with significant risks. Traditional trading still offers stability and regulatory safeguards. Diversifying investments in both markets might be a balanced approach. Each method has its pros and cons. As the financial landscape evolves, staying informed is crucial for making sound investment decisions.

Choose wisely and trade responsibly.